November 10 , 2026, Hong Kong

Insights

From A Status Quo To A Daily Beverage - China’s Wine Consumptions Is Hitting The Bars!

Huge population base, growing alcohol consumption amongst the young generation, and rising disposable income account for 1.24 billion liters of wine consumed in 2021 in China.

As the global consumption of wine increases, countries across the world focus on their production of wine and growing a larger export market. Amongst all the countries, China records a major consumption of wine and was ranked sixth by volume on the global wine consumption list in 2020. Major wine events like Vinexpo, Prowein, etc. have increased awareness amongst the consumers and have spread the word about Chinese wines. According to Global Data, the wine sector in China has projected growth from US$68.1 billion in 2019 to US$ 137.3 billion in 2024 with a CAGR of 14.7%. The growth is mostly projected by the increase in disposable incomes and the rising demand for premiumization which is driven by consumers preferring quality over quantity. Consumers in China often associate wine with their healthier drinks due to their low alcohol content and the perceived beauty and health benefits. For the same reasons, the female population consuming wine in China is vast.

Although a huge share of wine consumption in China is taken over by French wines as they are associated with higher quality and serve a more luxury-oriented consumer mindset. The Chinese New Year set new standards for China’s domestic wine and that took over rapid growth in 2021. “Guochao” which translates to a consumer’s favoritism toward domestic designs, brands, and culture has been a major influence on China’s domestic wine consumption. With the third-largest vineyard area and being the largest grape producer in the world, China contributes to nearly half of the world’s grape production. Major provinces including Shandong produce a great amount of wine and sell a bottle for US$2 or even less. China’s biggest wine producers like Changyu Pioneer Wine Company and GreatWall Winery are situated in the Shandong province and produce at least 200 million liters of wine individually every year. Other notable Chinese wineries that have gained momentum are Silver Heights, Legacy Peak, Tiansai Vineyards, Puchang, and Domaine des Arômes.

“The archetype of China is typically urban, educated, affluent, and international in their outlook, and their behaviors have clear similarities with consumers in developed wine markets.” - Richard Halstead, COO Wine Intelligence

The Wine Sector fo China; Image Adapted from Statista

Wine consumption in China has been greatly influenced by its developing e-commerce sector and the awareness amongst the consumers. Technological advances in the e-commerce industry have challenged major giants like Tmall and JD.com that account for 50.1% and 26.51% of the e-commerce market share in China (Source - IWSC). The major festivals like the Chinese New Year, Mid-Autumn Festival, and the popular Singles Day on 11th November, are the major days that sell the most wine throughout the year. However, wine drinkers are not associating drinking wine with celebration, status quo, or business anymore. Even though Baijiu tops the list of the most consumed alcohol in China, the census still estimates a population of 52 million wine drinkers. The monthly wine drinkers in China are roughly equivalent in size to the monthly wine drinking population of the UK which is a third of the same population in the U.S.

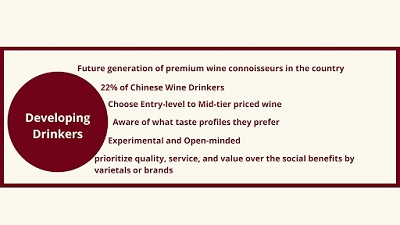

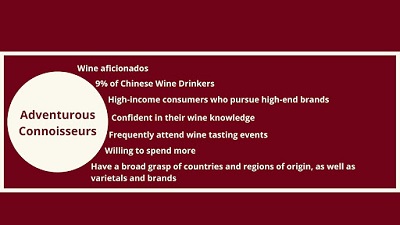

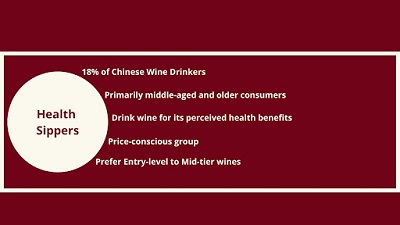

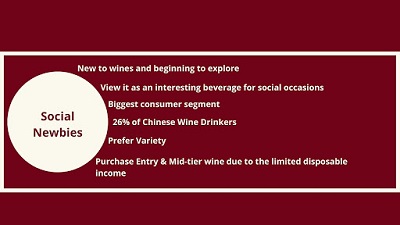

Types of Wine Consumers in China

Import Market of China

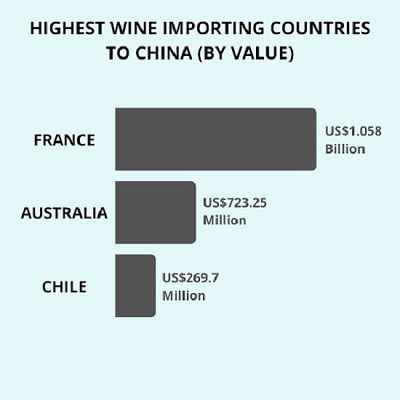

The wine marketplace of China is heavily invested in imported wines from Mediterranean countries like France and Italy due to their association with good taste and high quality amongst the Chinese wine drinkers. China grabbed the fifth position for the largest importer of wine in the world in 2020 and that has mostly comprised of imported wines from Australia, France, and Chile. These countries have been the leaders in China’s imported wine market and took up 70% of the share.

However, after the new tariffs imposed by China, the first place was shortly taken over by France. French wines, especially Bordeaux, have been a consistent favorite amongst the country’s fine wine drinkers as well as the wealthy. China also imports bulk wine in abundance which accounts for approximately 20% of the imports. The government of China reduced the VAT on imported wines thrice from 17% in 2018 to 13% in 2019 and finally to 14% in 2021. The import tariff now remains at 14% and excise tax at 10% which results in a tax rate of 43% on bottled wine.

Highest Wine Importing Countries to China; Image Adapted from NH global partners

Tapping the Future of the Chinese Wine Market

China is already turning into the world’s largest and most lucrative food and beverage market. As the middle class grows, the demand for premium lifestyle products also increases and so does the demand for wine. One of the most difficult groups to understand, designing a market strategy for the China wine market becomes essential and difficult to tap into. The domestic wine market has seen growth post-pandemic and some of the renowned wineries like Legacy Peak and Kanaan Winery have seen a growth of 118% and 40% respectively in 2021. However, the success of wine in China also comes with a cost and a danger of fraud. Renowned wine brands like Penfolds and Château Lafite Rothschild are frequent victims of copycat wine brands.

As the wine consumers in China grow, the demand for imported wine also grows which opens numerous avenues for countries across the world to tap into the market. Designing bottles similar to Bordeaux wine bottles and keeping the labels simple and traditional with the origin, AOC, and awards received, helps in increasing the sales of the wines. 30% of sales in China are majorly driven by tech-savvy millennials and which is why it becomes interesting to collaborate with social media influencers in China that have huge subscribers on WeChat and Weibo. They can help in infusing practical information through their posts and Livestreams which can eventually convert into sales. Wine influencers like Fongyee Walker MW and Edward Ragg MW hold immense knowledge about the wine industry and carry serious weight among knowledgeable consumers and can be a good catalyst in promoting wines amongst the Chinese wine consumers.

Article by Shreya Kohli, Beverage Trade Network

Header Image Source - Treasury Wine Estates Treasury Wine Estates

The 2025 China Competitions results are now live. View 2025 winners.

Key Dates

Super Early Bird Deadline: May 20, 2026

Early Bird Deadline: July 31, 2026

Regular Deadline: October 14, 2026

Warehouse Deadline: October 22, 2026

Judging Date: November 10, 2026

Winners Announcement: November 24, 2026